BTC Price Prediction: Bullish Megaphone Pattern Hints at Rally to $260K by 2026

#BTC

- Technical indicators show BTC is in a bullish phase with potential for short-term consolidation.

- Market sentiment is mixed, with strong institutional interest but some short-term volatility.

- Long-term price predictions remain highly bullish, driven by adoption and scarcity.

BTC Price Prediction

BTC Technical Analysis: Current Trends and Future Projections

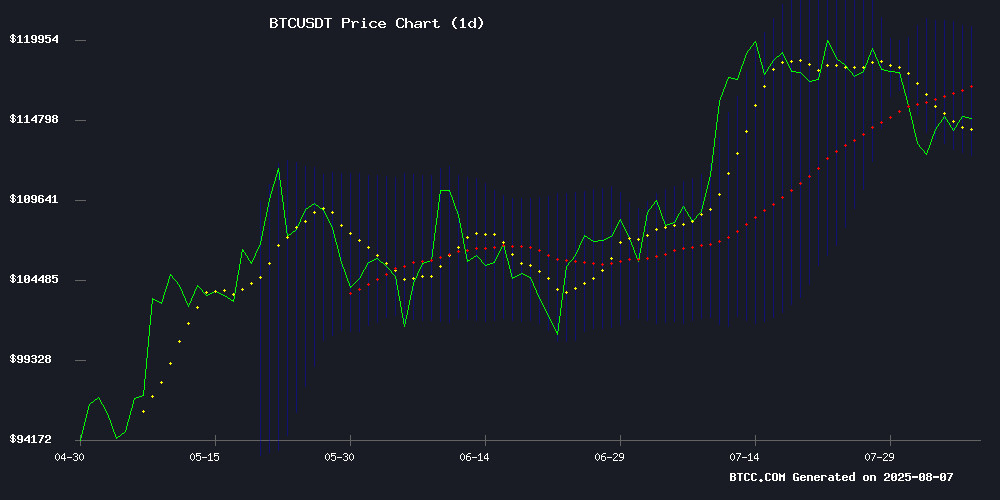

According to BTCC financial analyst William, BTC is currently trading at 116,584.92 USDT, slightly below its 20-day moving average (MA) of 116,745.96. The MACD indicator shows bullish momentum with the MACD line at 2,139.81 above the signal line at 792.50, and a positive histogram at 1,347.31. Bollinger Bands indicate a relatively stable price range, with the upper band at 120,798.63, middle band at 116,745.96, and lower band at 112,693.30. William suggests that while short-term consolidation is possible, the overall trend remains bullish.

Market Sentiment and News Impact on BTC

BTCC financial analyst William highlights a mix of bullish and cautious sentiment in the market. Positive news includes Bitcoin surpassing $116K amid bullish signals, institutional adoption by retirement funds, and the Fed exploring Bitcoin reserves. However, short-term investor confidence is wavering, and some analysts predict a delayed ascent to $1 million. William notes that these factors, combined with technical indicators, suggest a strong long-term outlook but potential volatility in the near term.

Factors Influencing BTC’s Price

Bitcoin's Million-Dollar Journey: Elliott Wave Theory Predicts Delayed Ascent

Bitcoin's path to $1 million may face a significant detour, according to a new Elliott Wave analysis by More Crypto Online. While the long-term bullish outlook remains intact, the study suggests a major correction could delay the milestone until after 2028.

The 1-week chart analysis indicates Bitcoin is completing Wave 3 of a five-wave structure, with a potential local top forming between $107,600 and $123,000. A retracement to $50,000 may precede one final push toward $133,691-$189,882 by 2026-2027—levels corresponding to key Fibonacci extensions.

Market watchers should brace for volatility: after testing these highs, the analysis projects a severe correction phase extending through 2028 before the next major bull cycle commences. "The million-dollar target remains valid," the report notes, "but the road there will demand patience."

Retirement Funds Embrace Cryptocurrency Investments as Regulatory Landscape Shifts

In a landmark move for institutional adoption, a new executive order will permit retirement funds to allocate capital to cryptocurrencies. The announcement, scheduled for 19:00 today, has already propelled Bitcoin toward the $117,000 mark. This policy shift reflects the growing recognition of digital assets as a legitimate asset class.

Separately, the New York DFS concluded its investigation into Paxos Trust Company's dealings with Binance. Paxos will pay $26.5 million in penalties for compliance failures, with an additional $22 million committed to overhauling its anti-money laundering protocols. "Our department remains committed to setting the standard for crypto regulation," stated Investigator Harris, emphasizing the need for robust risk management frameworks across regulated entities.

Fed Explores Using Gold Profits to Fund U.S. Bitcoin Reserve

The U.S. Federal Reserve is examining a novel approach to building a national Bitcoin reserve by leveraging profits from gold holdings. A research note dated August 1, 2025, by senior Fed economist Colin Weiss highlights how countries like Germany, Lebanon, and Italy have historically used gold and currency revaluation gains to finance expenditures without increasing debt.

With Bitcoin trading near $116,000, the proposal has garnered attention from policymakers and analysts. The U.S. Treasury's 261 million troy ounces of gold, if revalued at current market prices, could unlock approximately $850 billion in unrealized gains—equivalent to 3% of U.S. GDP. These funds could potentially seed a Strategic Bitcoin Reserve, as outlined in Senator Cynthia Lummis' BITCOIN Act.

Weiss notes that such strategies allow governments to avoid raising taxes or issuing additional debt. Belgium and the U.S. are among nations considering gold valuation gains as a fiscal tool. The move signals growing institutional interest in Bitcoin as a reserve asset amid broader adoption trends.

Bitcoin Price Prediction: Bullish Megaphone Pattern Hints at Rally to $260K by 2026

Bitcoin has surged 2% in the past 24 hours, pushing its market capitalization above $2.3 trillion. Spot trading volumes have reached $56 billion, signaling a resurgence in trader confidence following a recent dip.

Analysts are eyeing a bullish megaphone pattern on Bitcoin's chart, with one prominent trader projecting a potential rally to $260,000 by year-end. The pattern, characterized by expanding volatility and higher highs followed by lower lows, suggests accelerating buyer momentum. Mister Crypto, an analyst with over 140,000 followers, describes the formation as "perfect" and anticipates a significant upward move.

The potential breakout could energize the broader Bitcoin ecosystem, particularly Layer-2 solutions like Bitcoin Hyper. Institutional interest appears to be growing, with smart money already positioning for the next leg up.

JPMorgan Report Highlights Slow Growth in DeFi and Tokenization

Decentralized finance and asset tokenization continue to underperform expectations, according to a JPMorgan research report led by Nikolaos Panigirtzoglou. Despite incremental progress, both sectors face significant headwinds that have stifled institutional adoption.

Total Value Locked in DeFi protocols remains well below 2021 peaks, with activity still dominated by crypto-native users rather than traditional institutions. Regulatory fragmentation and legal uncertainties around on-chain assets persist as major barriers, concentrating most institutional crypto exposure in Bitcoin.

Tokenization efforts show promise but lack scale. While the sector counts $25 billion in tokenized assets and $8 billion in tokenized bonds, initiatives remain largely experimental. High-profile projects like BlackRock's BUIDL demonstrate technical viability but haven't achieved meaningful liquidity or secondary market activity.

Union Jack Oil JV to Mine Bitcoin Using On-Site Gas at West Newton

UK-listed Union Jack Oil and its joint venture partners, including Reabold Resources, have inked a non-binding letter of intent with Texas-based 360 Energy to launch Bitcoin mining operations at the West Newton gas field. The initiative will harness on-site natural gas to power mining data centers, converting stranded resources into a revenue stream while building a Bitcoin treasury.

The project underscores the growing convergence of energy and crypto industries, leveraging underutilized assets to fuel blockchain infrastructure. This model mirrors similar ventures in North America, where flared gas has found purpose in powering proof-of-work networks.

Bitcoin Faces Increased Pressure as Short-term Investor Confidence Wavers

Bitcoin's recent downturn has rattled short-term investors, with prices slipping below the critical $116,000 support level. The cryptocurrency peaked at $123,000 in mid-July before tumbling to $112,000 within weeks. Glassnode data highlights a stark shift: 120,000 BTC changed hands during the July 31 sell-off, while spot ETF outflows hit their highest since April.

The market's fragility is underscored by the erosion of profits for recent buyers. Holdings acquired one to three weeks ago now teeter on the edge of loss, with only 70% remaining profitable—down from 100%. Glassnode warns of a dangerous feedback loop: as losses mount, confidence wanes, potentially triggering further declines.

Despite the gloom, the substantial volume during the downturn suggests latent buying interest at lower prices. The market now walks a tightrope—any resurgence of large-scale selling could accelerate the downward spiral.

Salomon Brothers Completes Notification Process for 'Abandoned' Bitcoin Wallets

Salomon Brothers, the revived investment bank, has finalized its controversial initiative to tag allegedly abandoned Bitcoin wallets with OP_Return notices. The New York-based firm claims this preemptive measure aims to thwart potential access by rogue states or criminal entities. Targeting dormant addresses like the infamous 1Feex vault—holding approximately 80,000 BTC—the move leverages Bitcoin's blockchain as an immutable notification system.

Legal ambiguity surrounds the effort, with Salomon citing a 14-year inactivity threshold under the "Doctrine of Abandonment." Critics question both the methodology for eventual wallet reclamation and ties to figures like Craig Wright. Security experts warn of quantum hacking vulnerabilities, with Naoris Protocol CEO David Carvalho criticizing the Bitcoin community's sluggish response: "Draft BIP proposals are inadequate. Consensus delays could jeopardize $700 billion in dormant assets."

Bitcoin Surges Past $116K Amid Bullish Market Signals

Bitcoin climbed to $116,430, its highest level this month, as risk appetite returned following weak U.S. jobs data. The Federal Reserve is now widely expected to cut rates in September, with markets pricing in a 93.4% probability. Equities and cryptocurrencies benefited from a softening dollar and strong corporate earnings.

Institutional interest continues to grow, with the State of Michigan Retirement System increasing its Bitcoin ETF exposure. Despite the price rally, Bitcoin's 30-day volatility has dropped to 36.5%, reaching October 2023 levels—a sign of maturing market dynamics.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical and fundamental analysis, BTCC financial analyst William provides the following BTC price predictions:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | 120,000 - 150,000 | Institutional adoption, ETF approvals |

| 2030 | 300,000 - 500,000 | Mainstream adoption, scarcity |

| 2035 | 800,000 - 1,200,000 | Global reserve asset status |

| 2040 | 1,500,000+ | Full integration into global finance |

William cautions that these projections are subject to macroeconomic conditions, regulatory developments, and technological advancements.